Credito

Credito - Credit Intelligence in The Future

About Credito

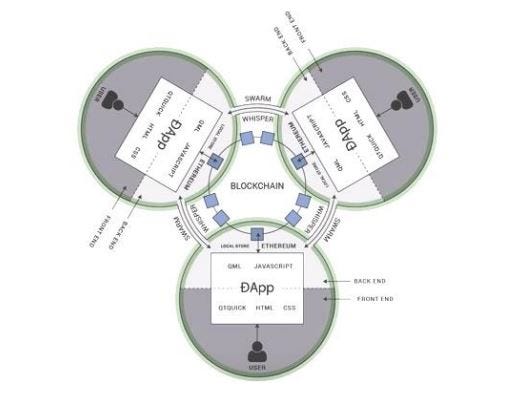

Credito is a decentralized credit intelligence network that provides credit scores, transaction scores and loan markets supported by the Ethereal blockfain, Intelligent Contracts and IPFS, enhancing transparency and reliability.

Introducing a decentralized lending market and allowing relationships between lenders and borrowers who are everywhere in the world. This eliminates physical constraints and reduces traditional borrowing and management costs. Visit https://credito.io/

Credit is a financial facility that allows a person or business entity to borrow money to buy the product and repay it within the specified time period.

Provision of money or invoices that can be based on loans and loan agreements between banks and other parties that require the borrower to execute with the amount of interest in return.

In day-to-day practice, credit insurance is in a material way. And as a security guarantee, the borrower will fulfill the obligations and submit the guarantee both material and non-material. To get the credit must go through the procedure determined by the bank / financial institution. In order for the implementation of credit activities can run with healthy and decent. One of the financial industry that develops a security program in crediting the institution is CREDITO.

What are the Needs for a Decentralized And Transparent Credit Information Platform?

Despite the efforts of banks, card issuers and merchants, credit card fraud continues to grow faster than credit card spending. Data violations have resulted in a more detailed compromise on the card, and the growth of online shopping has led to more opportunities for fraud via e-commerce. According to a 2016 report by Nilson1, credit card fraud losses reached $ 21.8 billion in 2015, an increase of 162% over 2010's $ 8 billion. Losses for 2016 are already estimated at more than $ 24 billion, and this loss is expected to reach $ 31 billion by 2020.

On the other hand, the peer to peer platform (P2P) is one of the fastest-growing segments in the financial services space. Alternative financial markets have gained popularity in recent years. The findings of Transparency Market Research show that "the opportunities in the peer-to-peer global market will be worth $ 898 billion by 2024, against 26 billion by 2015. The market is expected to grow at a CAGR of 48 percent between 2016 and 2024.

How to Solution From Credito?

Credit Is Transparent

Credito utilizes the transparency of the blockchain registry by monitoring the activities of borrowers and lenders to prevent one or the other from going beyond them. For example, this will be used to prevent borrowers from obtaining lots of loans from different lenders who will then tend to fail.

Loan Agreement is a Smart Contract

The Loan Credit Agreement is a self-enforcing agreement under the terms of the agreement between the Lender and the Borrower, which is directly written in a line of code, which increases transparency and reliability. The code and the key are on a decentralized decentralized string block network. The Loan Credit Agreement enables transactions and confidence agreements to be agreed between different and unnamed parties without the need for central authority, the legal system or external law enforcement mechanisms. They make transactions traceable, transparent and irreversible.

Credito is "Not Believe"

Credito will avoid the risks associated with third parties and eliminate the need to trust the opposing party. When the borrower archives loan applications on Credito Network, the counterpart can not manipulate or terminate the loan application after the loan is deployed. Eliminating the risk of the opposing party or a third party is important to avoid unfair and undesirable behavior.

Analytical Credit Machine

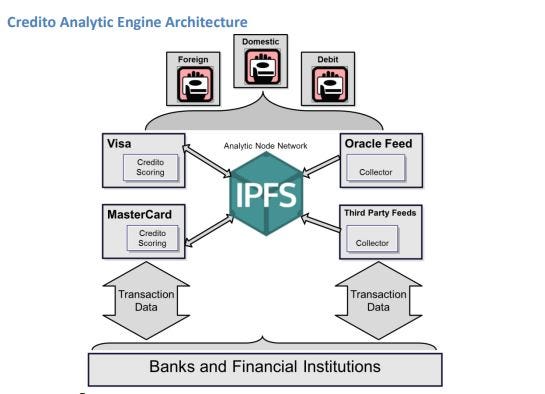

Credit score aims to get investor investment and credit value of the borrower. Credit scores are generated by Credito Analytic Engine, an independent learning algorithm using a sustainable feedback loop using Big Data Analytics, Machine Learning, and Artificial Intelligence, offering scores that act as dynamic probability markers. someone's replacement. the loan amount, which evolved with the loan repayment file of the client.

Token Distribution

To further develop, Credito will hold a one-time Token Generation ("TGE") event and massive credit sales, in which 50% of Token will be available for public sale. The TGE start date will be announced shortly, and will allocate a total Credit supply of 1 billion as follows:

Employee allocation will have a vesting period of 12 months, 25% for each quarter, with a 6-month cliff. The allocation will be proportional to each employee's employment on the date of sale of the token.

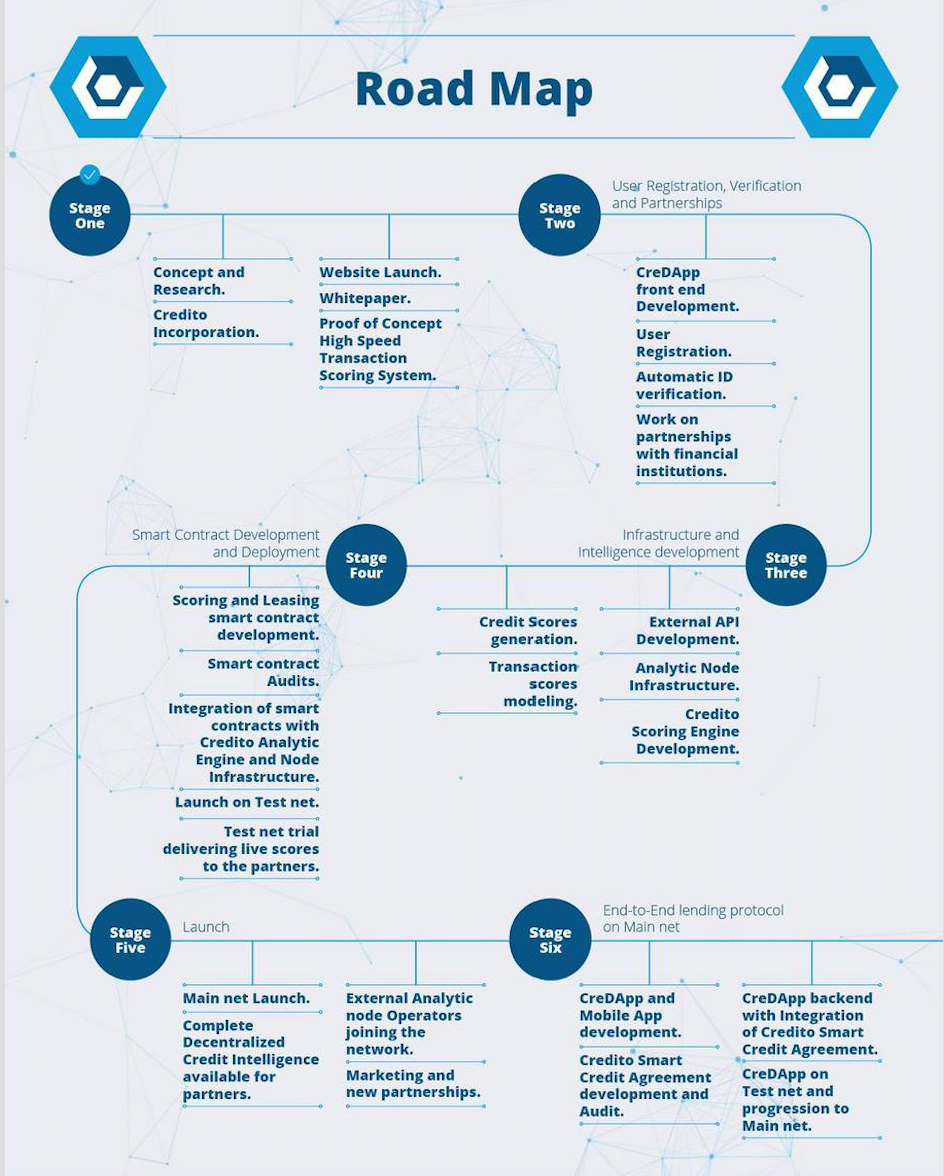

RoadMap

For More Information About Credito:

Website: https://credito.io/

White Book: https://credito.io/pdf/whitepaper.pdf

Telegarm: https://t.me/CreditoCommunity

Official Facebook page: https://www.facebook.com/CreditoNetwork

=================================================================== ==

Author: Reank85

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1913792

Eth Address: 0xa96dF2a7D1C9BD218530bb98369960b166FC5AB1

Komentar

Posting Komentar